Medicare Questions - Do you need quick answers? We have them.

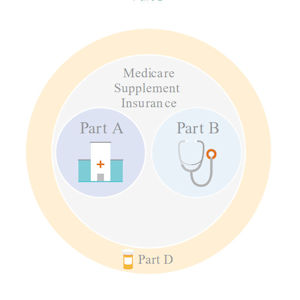

Medicare Supplement insurance is offered to protect our customers’ health and wallets. It’s a great option to add to your existing Medicare Part A and B plans, as Medicare supplement insurance helps cover some out-of-pocket costs that Part A and Part B may leave you with. .

Call us for a quote or questions regarding Medicare Supplement Plans at 713-369-0997

Basics

Short Answer

Medicare is a health insurance program provided by the U.S. government for people ages 65 plus, as well as younger people with certain disabilities.

However, Medicare does not cover all health care costs, and you can enroll in a Medicare supplement insurance or Medicare Advantage plan to receive fuller coverage.

More Details

Medicare is split into four parts: A, B, C, and D.

Part A helps pay for hospital expenses. There is no premium for Part A, but there are costs for you. Medicare supplement insurance and Medicare Advantage plans can help with these costs.

Part B helps pay for physician expenses. There is a premium, a deductible, and other costs for Part B. Medicare supplement insurance and Medicare Advantage plans can help with these costs.

Medicare Parts A and B are sometimes referred to as Traditional Medicare or Fee for Service Medicare. If you would like more coverage than Medicare Part A and Part B provide, you might be interested in a Medicare supplement insurance policy from an insurance company.

Part C is also known as Medicare Advantage. You can sign up for a Medicare Advantage plan through an insurance company. Medicare Advantage plans generally have low or no premium but do have copays and network restrictions. You must also continue to pay your Part B premium. You do not need both a Medicare Advantage and a Medicare supplement insurance plan. You only ever need one or the other.

Medicare Part D is the portion of Medicare that handles prescription drug coverage. You can sign up for a Part D plan through an insurance company. There will be a premium and some copays.

Short Answer

If you have a pre-existing condition, it is particularly important to make sure that you apply at the right time when the window for enrollment in Medicare supplement insurance and Medicare Advantage is open. A pre-existing condition is defined as any condition for which the patient has already received medical advice or treatment prior to enrollment in a new medical insurance plan.

More Details

- When you first enroll in Medicare Part B, and the first day of the month you turn 65, it starts your initial six-month Open Enrollment period. During that time, no plan can deny you coverage.

- Once you’re out of your initial enrollment period, you could be denied coverage for a Medicare supplement insurance plan due to health reasons, so it is important to get into the right plan for you during your initial Open Enrollment period.

- You cannot be denied coverage for a Medicare Advantage plan during the Annual Enrollment Period from October 15 to December 7 each year, even if you have a pre-existing condition.

The short answer is no. Medicare coverage is individual coverage. That means that you and your spouse/partner each need to sign up for one plan per person. You cannot share a plan. Each of you must decide which Medicare option is best for you.

Short Answer

You do not need to be collecting Social Security to enroll in Medicare. If you are collecting Social Security when you turn 65, you will be enrolled in Medicare Part A automatically. However, you will still need to sign up for Part B, and this will start your initial six-month Open Enrollment period. Part B requires a monthly premium, and you can elect to have that premium deducted from your Social Security benefits if you choose.

More Details

Enrolling in Part B is an important decision. It kicks off your initial six-month Open Enrollment period beginning on the first day of the month you turn 65. During this time, no plan can deny you coverage, so it’s an important time to select the right plan for you.

Short Answer

While they sound alike, Medicare and Medicaid are different. Medicare is a health insurance program provided by the U.S. government for people ages 65 plus, as well as younger people with certain disabilities. Medicaid is a government health program designed specifically to help low-income people afford health care.

Short Answer

We hear you, and we understand this can all be confusing. You are not alone. Here’s a quick rundown of your decisions: You need to decide if you should sign up for Medicare Part B. Then, if you want additional coverage, you need to decide between Medicare supplement insurance and Medicare Advantage plans and choose an insurance company to purchase coverage through. Finally, you need to make sure you have drug coverage.

More Details

- When you first enroll in Medicare Part B, it starts your initial six-month Open Enrollment period. During that time, no plan can deny you coverage.

- Once you’re out of your initial enrollment period, you could be denied coverage for a Medicare supplement insurance plan due to health reasons, so it is important to get into the right plan for you during your initial Open Enrollment period.

- You cannot be denied coverage for a Medicare Advantage plan during the Annual Enrollment Period from October 15 to December 7 each year, even if you have a pre-existing condition.

Short Answer

You can continue to be covered through your own plan or through a spouse’s/partner’s plan if you still qualify. Make sure you check with the sponsor of your existing policy.

More Details

There are times when someone may be eligible for Medicare but continues to be on an employer plan:

- You might be retired and still on your former employer’s plan

- You or your spouse/partner might still be working and on an employer’s plan

Generally, in these cases, you will sign up for Medicare Part A, but not Medicare Part B. Signing up for Medicare Part B triggers your six-month Open Enrollment period beginning the first day of the month you turn 65. You want to save that until you are switching to a Medicare supplement insurance or Medicare Advantage plan.

Short Answer

Premiums are regular amounts you pay for coverage. Most people with Medicare supplement insurance plans pay monthly premiums. These premiums can go up over time.

A deductible is a dollar amount you need to pay out of pocket before your coverage begins paying.

Copays are dollar amounts you pay whenever you receive a certain procedure.

Coinsurance is a percentage of the total charge you pay whenever you receive a certain procedure.

Costs and Benefits

Short Answer

Medicare doesn’t pay vision, dental, or hearing benefits unless they are related to a larger medical occurrence. Generally, Medicare supplement insurance plans do not offer these benefits, either. Medicare Advantage plans might contain vision, dental, or hearing benefits.

Some Medicare supplement insurance and Medicare Advantage plans will contain a special feature for a free gym membership, but not all do. These are not insurance benefits. (Our Medicare supplement products do not currently include a free gym membership.)

Short Answer

Medicare is split into different Parts. Part A is generally free, and Part B has a monthly premium. In addition to Part A and Part B, you may elect to purchase a Medicare supplement insurance plan, which will have a monthly premium.

Alternatively, you may elect to enroll in a Medicare Advantage plan. You will still need to pay the Part B premium, and there may or may not be an additional monthly premium for your Medicare Advantage plan.

More Details

Here are the specific rules for Part A and Part B of Medicare:

Part A (Hospital Insurance) – Free to anyone who has paid Federal Insurance Contribution Act (FICA) tax for 10 years or 40 quarters. That’s the federal employment tax you and your employer paid while working. It funds Social Security and Medicare. The rules are slightly different for railroad employees.

You can still get Part A if you haven’t met these requirements but you will pay a premium. There is a 10 percent late penalty if you don’t enroll when you’re first eligible. You have to pay that premium for twice the number of years you could have had Part A, but didn’t sign up

Part B (Medical Insurance) – Everyone is required to pay a premium for this coverage. The federal government sets the amount each year. You can have it deducted from your Social Security benefits

Short Answer

Generally, Medicare Part B and Medicare supplement insurance plan premiums increase each year. Medicare Advantage plans may change premiums and cost sharing each year.

Short Answer

Medicare generally doesn’t pay any coverage for care received outside the US. Many Medicare supplement insurance plans pay 80 percent of Medicare approved costs after a $250 deductible and up to a lifetime $50,000 limit for emergency care that begins during the first 60 days of each trip. Medicare Advantage plans are based on networks and generally don’t pay for any care received outside the US.

Short Answer

With a Medicare supplement insurance plan, your premium can increase over time. Your insurance company will notify you in advance of any premium changes.

With a Medicare Advantage plan, changes cannot occur in the middle of a year but can change each calendar year.

Short Answer

With a Medicare supplement insurance plan, your benefits will not change over time. Your premium may increase, and if your plan does not cover deductibles, the amount of those deductibles will change annually.

Medicare Advantage plans can be changed each calendar year. You can always switch Medicare Advantage plans during the Annual Enrollment Period from October 15 to December 7 each year.

Short Answer

Medicare supplement insurance plans generally pick up the portion of Medicare approved costs that Medicare does not pay. Medicare supplement insurance plans are standardized, meaning each company’s Plan F will pay the same basic benefits.

Medicare Advantage plans are unique and may have different benefits as well as different deductibles and cost sharing. Medicare Advantage plans generally have network restrictions.

Coverage

Short Answer

You may be surprised to learn that government-provided Medicare doesn’t cover 100 percent of health care costs. However, there are coverage options available to you. You can enroll in Medicare and purchase a Medicare supplement insurance plan. Alternatively, you can enroll in a Medicare Advantage plan.

The personalized recommendation on this site can help you choose between Medicare supplement insurance and Medicare Advantage.

In addition, Part D is the portion of Medicare that provides prescription drug coverage. You can purchase a Part D plan in addition to a Medicare supplement insurance plan, while many Medicare Advantage plans include prescription drug coverage.

Medicare is divided into separate parts (Part A, Part B, Part C, Part D). Medicare Parts A and B are handled through the government. Medicare Part C is another name for Medicare Advantage, which is optional insurance you can get through an insurance company. Medicare Part D is the drug coverage portion of Medicare.

Medicare supplement is insurance coverage that is defined by the government. There are different Medicare supplement insurance plans (Plan A through Plan N). Because Medicare supplement insurance plans are defined by the government, a specific plan, like Medicare supplement Plan F, will offer the same basic benefits no matter what company you purchase it from. (Some companies may introduce small additional features like gym memberships, but all health care benefits are the same. These additional features are not insurance benefits.)

Short Answer

Both Medicare supplement insurance and Medicare Advantage plans are coverage options for Medicare enrollees. However, the terms of applying/enrolling and coverage differ between the two, and it is important to understand the differences.

More Details

Medicare supplement insurance Plans:

- Are good for people who would rather pay higher premiums in exchange for lower costs when they do see a doctor

- Help cover the remaining portion of Medicare approved expenses that Medicare doesn’t pay

- Are standardized, meaning the basic benefits of each plan are the same regardless of the company offering it

- Do not have network restrictions

- Do have monthly premiums

- Cannot deny you coverage when you first enroll in Medicare

- Are guaranteed renewable, meaning you are covered as long as you pay the premium within the grace period (except in cases of material misrepresentation by you)

Medicare Advantage Plans:

- Are good for people who would rather pay low or no monthly premiums in exchange for costs when they do see a doctor

- Are not standardized and vary by insurance company

- Have network restrictions and often Primary Care Physicians coordinating care

- Often have copays and coinsurance

- May have low or no monthly premiums, however you must continue to pay your Medicare Part B premium

- Cannot deny you coverage when you first enroll in Medicare and each year during the Annual Enrollment Period from October 15 – December 7

Short Answer

You cannot always change your coverage, so it’s important to be confident in your choice. Doing research up front and understanding your plan are excellent ways to help ensure the coverage you choose is right for you.

More Details

Many people decide to either purchase a Medicare supplement insurance plan in addition to Medicare Part A and Part B or to enroll in a Medicare Advantage plan.

Medicare supplement insurance plans are required to accept people who are in their initial six-month Open Enrollment periods. However, after that, you may be denied coverage due to health conditions.

Medicare Advantage plans, on the other hand, are required to accept anyone in their initial six-month Open Enrollment period and anyone who applies during the Annual Enrollment Period from October 15 to December 7 of each year.

Short Answer

Your plan cannot drop you as long as you continue to pay premiums within the grace period (except in cases of material misrepresentation on your part).

More Details

Medicare supplement insurance plans cannot cancel your coverage as long as you pay premiums within the grace period (except in cases of material misrepresentation on your part).

Medicare Advantage plans are up for renewal every year, and there is a possibility your Medicare Advantage plan will not continue into the next year. In that case, you would need to find new coverage during the Annual Enrollment Period from October 15 to December 7.

Short Answer

If you purchase a Medicare supplement insurance plan, you can see your doctor if they accept Medicare patients. If you purchase a Medicare Advantage plan, you can see only the doctors in the plan’s network. Your current doctor may be in the plan’s network.

More Details

If a doctor does not accept assignment from Medicare, they can bill you an additional amount beyond what Medicare pays them. If you have a Medicare Advantage plan, you can only go to your doctor if your doctor is in the plan’s network.

Short Answer

Generally, Medicare covers hospital expenses, physician visits, prescription drugs and skilled nursing care following a hospital stay. Outpatient prescription drugs are covered only if you have a Part D plan.

More Details

The program is divided into these four parts:

- Part A – Hospital Insurance. Think of this part as places, like a hospital, hospice or a skilled nursing facility (after a hospital stay). For most people, there is no monthly premium for this coverage. But you may have deductibles and copayment for certain hospital expenses

- Part B – Medical Insurance. Think of this part as people, like doctors or specialists. This pays for outpatient care at clinics and doctors’ offices. You pay a copay of up to 20 percent. In addition, you pay a monthly premium which is set by the federal government each year

- Part A and B together are sometimes called “traditional medicare” or “original Medicare”

- Part C – Medicare Advantage Program. This program delivers benefits through private managed care networks, like a Preferred Provider Organization (PPO) or Health Maintenance Organization (HMO). They include Part A and Part B benefits. They may also pay for essentials not covered by Medicare, like hearing aids and dental care. Frequently, benefits for Part D (see below) are also included

- Part D – Prescription Drugs. This pays for prescription drugs. You share in the cost with copays. This coverage is not required but is strongly recommended. You sign up for it with a private insurance company that is paid by Medicare

Short Answer

Medicare does not cover outpatient prescription drugs. So you will want to sign up for Part D Prescription Drug coverage. If you do not have creditable coverage, you will need to purchase a Part D plan from an insurance company. Note that this is separate from a Medicare supplement insurance plan. Many Medicare Advantage Plans include Part D coverage.

More Details

It is important to always either have creditable coverage or a Part D plan once you turn 65. If you are covered under an employer or spouse’s/partner’s employer plan, you will be notified if what you have is creditable coverage. If you will not have creditable coverage upon turning 65, you should enroll in a Part D plan. Skipping Part D enrollment means you will need to pay a monthly penalty if you ever do decide to enroll in Part D.

If you purchase a Medicare supplement insurance plan, you will need to purchase a separate Part D plan.

If you enroll in a Medicare Advantage plan, it may already include prescription drug coverage.

Enrolling

Short Answer

Generally, yes. For most people, Medicare Part A is free and works with any existing coverage.

More Details

If you are collecting Social Security upon turning 65, you will automatically be enrolled in Part A. Otherwise, you can enroll by contacting the Social Security office.

Short Answer

If you are enrolling in Medicare and will no longer be covered under another plan, you should generally enroll in Part B. This will trigger your Open Enrollment period during which you should make decisions regarding any additional coverage.

More Details

When you first enroll in Medicare Part B, you start your initial six-month Open Enrollment period beginning the first day of the month you turn 65. During this time, no Medicare supplement insurance or Medicare Advantage plan can deny you coverage, so it is an important time to find the right coverage for you.

Short Answer

Medicare is for people who are age 65 and older. In some instances, Medicare also covers younger people with disabilities.

More Details

When you apply for Medicare, you’ll sign up for:

- Part A (Hospital Insurance). It will coordinate with any existing coverage you have

- Part B (Medical Insurance). If you elect to enroll in Part B, it will trigger your six-month Open Enrollment period beginning the first day of the month you turn 65. This is the time when you can apply for Medicare supplement insurance coverage regardless of your health history. After that time, you may be denied based on your health

Or you can turn it down and enroll in Part B later. Usually this is used if you are still working and are covered under a group plan. If you choose not to take it for another reason, you may have to wait until the next enrollment period and pay a late enrollment penalty every year. You may not be covered under another plan if you have Part B.

If you want a Medicare Advantage policy, you should still sign up when you enroll in Part B. However, with Medicare Advantage there is an Annual Enrollment period from October 15 to December 7. Remember that Annual Enrollment and Open Enrollment are not the same thing.

Short Answer

You can enroll in Medicare starting three months prior to the month of your 65th birthday and extending for three months after the month of your birthday. (If your birthday is on the first of the month, you can enroll beginning four months prior to the month of your 65th birthday but only two months after the month of your birthday).

More Details

Missing your Medicare enrollment can have serious consequences. If you do not sign up for Part B and do not have health coverage after becoming eligible for Part B, you will pay a penalty if you ever do get Part B. The penalty lasts as long as you have Part B.

Also, signing up for Medicare supplement insurance, Part D, and Medicare Advantage plans is impacted by when you enroll in Medicare. After enrolling in Medicare, be sure to sign up for any other coverage you need.

Short Answer

Missing your Medicare enrollment date can have serious consequences. Enrolling in Medicare Part B is a key event. When you sign up, you begin your Open Enrollment window. During your Open Enrollment you cannot be denied a Medicare supplement insurance plan, a Medicare Advantage plan or Part D—even if you have a pre-existing condition. A pre-existing condition is defined as any condition for which the patient has already received medical advice or treatment prior to enrollment in a new medical insurance plan. This all changes if you enroll late.

More Details

If you miss Open Enrollment, you could face the following situations:

- Part B Medical Insurance: If you do not sign up for Part B on time and do not have health coverage, you will pay a penalty if you ever do get Part B for as long as you have Part B

- Part C Medicare Advantage Plan: You will need to wait until the Annual Enrollment Period, which runs from October 15 to December 7. This means you will not have any additional coverage until January 1 of the following year

- Part D Prescription Drug: You will need to wait until the Annual Enrollment Period from October 15 to December 7. Additionally, when you do sign up for a Part D plan, you will pay a penalty premium for as long as you have Part D, if you did not have creditable coverage before signing up

- Medicare Supplement Insurance Plan: You can apply for this plan at any time, but you could be denied coverage based on existing health conditions

Short Answer

Age 65 is the trigger to enroll in Medicare. You can enroll as early as three months before your 65th birthday or as late as three months after you turn 65. If your birthday falls on the first of the month, you can enroll four months prior to your birthday and up until two months afterward.

You should generally enroll in Medicare Part A at age 65. However, you may want to delay enrolling in Part B of Medicare if you still have other health coverage through an employer, a spouse’s/partner’s employer, or another source.

More Details

If you’re turning 65, you can enroll for Medicare online at a secure government website. It takes as little as 10 minutes and you avoid a trip to a Social Security office. You don’t have to complete the online application in one sitting. You can stop and restart it later without losing your information.

Just follow the instructions on the site. You can print out a receipt and get an application number for your records. Social Security will process your application and mail your Medicare card. You can also check your application status online.

If you are collecting Social Security, you will be enrolled in Medicare Part A automatically, with some exceptions. But you’ll still need to sign up for Medicare Part B, and this will start your Open Enrollment period, which is an important decision point.

If you don’t want to apply online, here are two other choices:

- Visit your local Social Security office (Call to make an appointment first)

- Call the Social Security Office at 800-772-1213 from 7 a.m. to 7 p.m. Monday through Friday

Short Answer

Part D plans are plans from insurance companies which cover prescription drug expenses. If you purchase a Medicare supplement insurance plan, you will need to purchase a Part D plan separately. However, if you enroll in a Medicare Advantage plan, Part D coverage may already be included.

More Details

It is important to always either have creditable coverage or a Part D plan once you turn 65. If you are covered under an employer or spouse’s/partner’s employer plan, you will be notified if what you have is creditable coverage. If you will not have creditable coverage upon turning 65, you should enroll in a Part D plan. Skipping Part D enrollment means you will need to pay a monthly penalty if you ever do decide to enroll in Part D, as long as you have Part D.

Short Answer

You can work with an agent/producer to obtain Medicare supplement insurance or Medicare Advantage coverage. You can also build a personalized recommendation on this site, which will guide you to a purchase channel.

Switching Plan

Short Answer

If you purchased a Medicare supplement insurance plan, you can apply for a different Medicare supplement insurance plan at any time, but you may be denied coverage due to health conditions. You may also apply for a Medicare Advantage plan during the Annual Enrollment Period from October 15 to December 7 of each year. You cannot be denied this coverage, and it will be effective the following January 1.

If you purchased a Medicare Advantage plan, you can apply for a Medicare supplement insurance plan at any time, but you may be denied coverage due to health conditions. You may also apply for a Medicare Advantage plan during the Annual Enrollment Period from October 15 to December 7 of each year. You cannot be denied this coverage, and it will be effective the following January 1.

Part D plans are a little unique. You can enroll in any Part D plan at any point during the Annual Enrollment Period from October 15 to December 7 of each year. However, many Medicare Advantage plans include Part D coverage. If you are switching from Medicare Advantage to Medicare supplement insurance, be sure to also purchase Part D coverage. If you are switching from Medicare supplement insurance with a separate Part D plan, you might be able to switch to a Medicare Advantage plan that includes Part D coverage. If this is the case, you would not need your separate Part D plan. With Part D, it is important to always have a Part D plan or creditable coverage in force.

Short Answer

If you have a Medicare supplement insurance plan, you will generally not need to switch anything with your coverage. When you move, your premium may change.

If you have a Medicare Advantage plan and move out of the network, you may be eligible for a special enrollment period into another Medicare Advantage Plan at your new address.

Short Answer

If you get sick, you may not immediately be eligible for additional coverage, so it is important to plan early and make the right long-term choice.

More Details

If you want a Medicare supplement insurance plan and are not in your initial six-month Open Enrollment period, you may be denied coverage based on health conditions.

If you want a Medicare Advantage plan, you will need to wait until the Annual Enrollment Period from October 15 to December 7 of each year to sign up for a Medicare Advantage plan that starts on January 1 for the following year.

Short Answer

You can apply for a Medicare supplement insurance plan at any time, but you may be denied coverage due to health conditions. You may also apply for a Medicare Advantage plan during the Annual Enrollment Period from October 15 to December 7 of each year. You cannot be denied this coverage, and it will be effective the following January 1.

Short Answer

You do have options when it comes to switching plans, but they are limited to time frames and may be limited if you have certain health conditions. This is why it’s so important to really understand this decision and think through what could happen long term with your health.

Remember, if you are feeling lost, you can always receive a personalized recommendation on this site.

More Details

You can apply for a different Medicare supplement insurance plan at any time, but you may be denied coverage due to health conditions.

You may apply for a Medicare Advantage plan only during the Annual Enrollment Period from October 15 to December 7 of each year. You cannot be denied this coverage, and it will be effective the following January 1.

Short Answer

If you are happy with your coverage and you have not received notice that the coverage is ending for any reason, you do not need to do anything.

More Details

- There are different renewal rules for different pieces of Medicare

- You will automatically keep Medicare Part A. You will automatically keep Part B as long as you pay the Part B premium

- Part D – You will automatically be re-enrolled each year unless the plan is being phased out. If that’s the case, you will be notified, and you will need to pick a new Part D plan for the following year during the Annual Enrollment Period from October 15 to December 7

- Medicare supplement insurance – Your coverage will automatically be renewed as long as you pay your premium within the grace period

- Medicare Advantage – You will automatically be re-enrolled each year unless the plan is going away. If that’s the case, you will be notified, and you will need to pick a new Medicare Advantage plan for the following year during the Annual Enrollment Period from October 15 to December 7

Short Answer

This is only an issue for Part D plans and Medicare Advantage plans. If your plan is no longer available, you will be notified by your plan and will need to select new coverage for the following year during the Annual Enrollment Period. You cannot be denied coverage during this period.

Short Answer

You can apply for a new Medicare supplement insurance plan at any time. However, you could be denied due to health conditions.

Each year, during the Annual Enrollment Period from October 15 to December 7, you can enroll in a Medicare Advantage plan. You cannot be denied by a Medicare Advantage plan during this window.

To choose the right coverage, you need to know the basics about Medicare. We’ve collected everything you need to know about Medicare, so you can pick the plan that best fits your needs.

Original Medicare

Parts A and B offered by the federal government

Hospitals

This is called Part A.

Part A covers inpatient hospital care. While you are in the hospital, it covers everything that is crucial for your treatment. Like your medications, X-rays, lab tests, operations, and meals. It can also pay for necessary follow-ups to inpatient care like physical therapy or skilled home nurse care. And, it covers hospice services for the terminally ill.

The federal government provides Part A, and most people don't pay a monthly premium. If you're admitted to a hospital, there's a deductible and some further cost sharing that you pay.

Doctors

This is called Part B.

Part B covers doctor’s care when you’re sick or have a medical condition. It pays for outpatient hospital and clinic care, lab tests, and some nursing care at home if you’re homebound. Part B generally makes it easier to get preventative care, including things like your annual wellness exam, preventative screenings, and yearly flu shots. It can cover the medical equipment you need for your home. And it can cover you if you have to go to the Emergency Room. It also covers most doctor services while you’re in the hospital.

The federal government provides Part B, and you’ll have to pay a monthly premium. For visits to the doctor, part B has a deductible and some cost sharing that you pay.

Your options beyond Parts A and B

These are your options offered by Private Insurance Companies

An All-in-One option you can purchase to replace Part A and B

These Policies are often purchased separately to supplement Part A and B

Medicare Advantage

This is called Part C.

Medicare Advantage combines the coverage of Part A and B – Original Medicare, plus extra benefits. Many plans include prescription drug coverage as well as dental and vision care. Some plans have no copays for most labs or tests. And some even have extra benefits like gym memberships and transportation.

Most plans offer $0 premiums, but you do have to pay your Part B premium. Most plans have copays for treatment. And you’ll continue to pay your Part B premium. Medicare Advantage plans have a yearly limit for out-of-pocket costs you have to pay. Once you reach that amount, you won’t pay more for any of your Medicare costs, your plan will cover it. Different plans have different maximums.

Medicare Advantage plans work all by themselves. They replace Medicare Parts A and B and because of this all-in-one approach, you don't pair them with Medicare Supplement policies.

Prescription Drug Plan

This is called Part D.

Part D covers your prescription drugs and is a great addition to pair with Medicare supplement insurance. You probably won’t need it if you get Medicare Advantage since most Medicare Advantage plans include it. Remember what prescriptions are covered depends on which plan you get. But you most likely won’t need it if you choose Medicare Advantage instead. You can also pair it with Medicare supplement insurance for even more coverage. Just remember: which prescriptions are covered depends on which plan you get.

You have to get your Prescription Drug Plan through a private insurer, like Mutual of Omaha. You’ll pay a monthly premium and a yearly deductible. You'll also pay a coinsurance (a percentage of the cost for your prescriptions) or a copay (a flat fee for some of your prescriptions’ cost).

Medicare Supplement Insurance

This is also called Medigap.

Medicare Supplement (also known as Medigap) covers things that Original Medicare doesn’t, like copays, deductibles, and coinsurance. It does all this with a steady, predictable, monthly bill you can budget for. And it can’t be cancelled. It will be renewed for as long as you pay your premium on time.

You can add a Prescription Drug Plan and a Dental plan to Medicare supplement insurance to get even more coverage.

You have to get Medicare supplement insurance through a private insurer, like Mutual of Omaha. You’ll have to pay a monthly premium and depending on the plan you may also have copays.

Two Different Options for Comprehensive

Medicare Coverage

Sign up for an all-in-one plan that provides the coverage of Part A, Part B, and Part D. This plan also covers extra benefits like dental, hearing, and transportation.

Put the pieces together to build the coverage that’s right for your health and wallet. Enjoy the flexibility of choosing just the benefits you want.

How do these plans compare?

MEDICARE ADVANTAGE

ORIGINAL MEDICARE + MEDICARE SUPPLEMENT INSURANCE+ PART D

How do these plan types differ?

There are many ways a Medicare Advantage plan differs from Medicare Supplement. With Medicare Advantage, you will have an all-in-one plan with low or no monthly premiums, but you’ll have higher out-of-pocket payments when you do use your health plan, though there are limits to how much you have to pay. Medicare Advantage plans are also affiliated with specific health provider networks, so you will be limited to doctors in these plans.

There are many ways a Medicare Supplement plan differs from a Medicare Advantage one. With Medicare Supplement, you will pay higher monthly premiums but will have fewer out of pocket costs when you do use your health plan. Also, you are permitted to see any doctor who accepts Medicare.

Will I Need A Referral To See A Specialist?

Doctors in your approved network.

Any doctor who accepts Medicare.

Is the Plan Offered Where I Live?

It depends. Since not every insurance company offers plans in each area, you’ll need to choose from a company that offers it where you live. And in some cases, there may not be a plan available at all.

Yes – a plan is available in your area. Since not every insurance company offers plans in each state, you’ll need to choose from a company that offers it in your area. And plans are standardized differently in Massachusetts, Minnesota, and Wisconsin.

I Live in a Rural Area, Will There Be a Doctor Close to Me I Can See?

It depends. Most plans center around a specific hospital, so there may not be a doctor in your network close to where you live.

Most likely. You can see any doctor that accepts Medicare, and there are doctors in most rural areas that do.

Will I be covered if I travel across the United States?

Yes, you will be covered for any urgent or emergency care while traveling, however, routine care outside of the plan’s network is not covered.

Yes. Just like with Medicare, you can travel the country and see any doctor that accepts Medicare.

Will I be covered if I travel across the world?

For most plans, only emergency services are covered outside of where you live.

Plans F, G, and N cover it.

Are prescriptions covered?

Most Medicare Advantage plans include prescription drug coverage, but all plans have rules for which drugs are covered.

When you get a separate Prescription Drug Plan that complements Medicare Supplement Insurance, you’re covered. But all plans have rules for which drugs are covered.

Is Dental Included?

Most plans include it.

No, but a separate Dental Plan pairs well with Medicare Supplement Insurance.

Is Vision Included?

Most plans include it.

No, but a separate Vision Plan pairs well with Medicare Supplement Insurance.

Are There Extra Benefits?

Yes. There are benefits like hearing, fitness memberships, and transportation.

Some insurance companies offer extra benefits.

What is the Stability of the Benefits?

Benefits may change from year to year. Most plans only have slight changes though

Your Medicare Supplement Insurance benefits will always stay the same.

Can my plan be canceled?

Plans can be canceled at the end of the calendar year. Most choose to renew though.

No. As long as you pay your premiums, your plan can’t be canceled.

Will I need to pay copays or coinsurance?

Yes. Learn more about copays and coinsurance.

It depends on the plan. Learn more about copays and coinsurance

Will I need to pay a premium?

Yes, but most plans have a low or $0 monthly premium. You’ll also need to pay your Part B premium.

Yes. You’ll pay a monthly premium in addition to your Part B premium.

Explore the Medicare Advantage Plans in your county

Your open enrollment period starts when you turn 65 or when you first sign up for Part B. It lasts for 6 months. This is the best time to sign up, because you’ll get the best possible rate and can’t be denied for a pre-existing condition. After this 6-month window closes, you can still apply but the insurance company may use medical underwriting. There is also the possibility that you could be denied.

See the Medicare Supplement Plans Available in your state

Your open enrollment period starts when you turn 65 or when you first sign up for Part B. It lasts for 6 months. This is the best time to sign up, because you’ll get the best possible rate and can’t be denied for a pre-existing condition. After this 6-month window closes, you can still apply but the insurance company may use medical underwriting. There is also the possibility that you could be denied.

The ABC's of Medicare

To choose the right coverage, you need to know the basics about Medicare. We've collected everything you need to know about Medicare, so you can choose the best plan.

Learn the Basics

Answering Your Questions

Here you can find answers to commonly asked questions, everything from the basics all the way to how to switch plans. Frequently Asked Questions

Medicare Advice Center

Answer a few simple questions to get a customized recommendation on what Medicare Solution works best for you.

Get Your Recommendation